SoftBank’s Nvidia divestment shakes markets and prompts investor concerns.

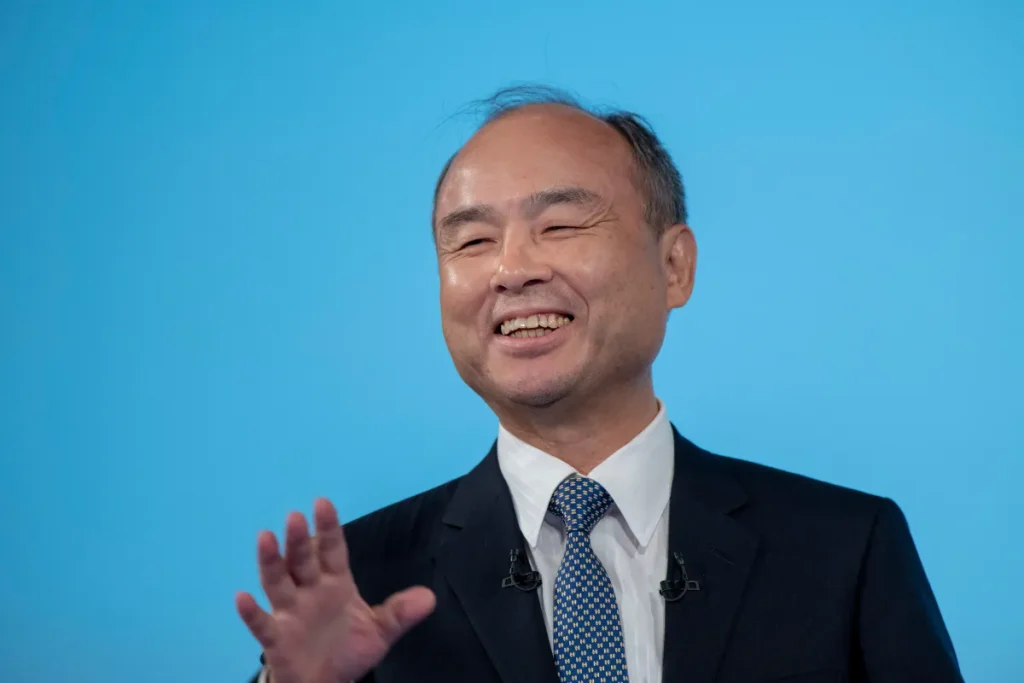

Image Credits:Alessandro Di Ciommo/NurPhoto (opens in a new window) / Getty Images

Masayoshi Son’s Bold Bet on AI: Liquidating Nvidia Stake

Masayoshi Son is no stranger to high-stakes gambles. As the founder of SoftBank, his journey has been characterized by remarkable investments that often defy conventional wisdom. Recently, he made headlines by divesting his entire $5.8 billion stake in Nvidia to fully commit to artificial intelligence (AI). Given Son’s history, this daring move may not be as surprising as it seems; after all, it’s almost expected for Son to go “all-in.”

The Rise and Fall: A Turbulent History

Son’s financial trajectory has been a rollercoaster. During the dot-com bubble of the late 1990s, his net worth skyrocketed to approximately $78 billion, making him the world’s richest person by February 2000. However, just months later, the infamous dot-com crash wiped out $70 billion of his fortunes—at the time, the largest loss by an individual in history. SoftBank’s market capitalization nosedived from $180 billion to a mere $2.5 billion.

Despite this calamitous turn of events, Son made a defining investment in 2000: he committed $20 million to Alibaba after a brief six-minute encounter with its founder, Jack Ma. That initial investment eventually ballooned to an astounding $150 billion by 2020, marking a significant turnaround and solidifying Son’s reputation as a savvy venture capitalist.

Controversial Investments

Son’s success with Alibaba has sometimes obscured moments when he may have overstayed his welcome at the investment table. In 2017, when he sought to launch his first Vision Fund, he approached Saudi Arabia’s Public Investment Fund for $45 billion—a bold move in the pre-2020 climate where accepting Saudi money was heavily scrutinized in Silicon Valley.

Following the tragic murder of journalist Jamal Khashoggi in October 2018, Son condemned the act but maintained that SoftBank couldn’t sever ties with Saudi investment, emphasizing a commitment to the Saudi people. Interestingly, this period saw an acceleration in deal-making activities for the Vision Fund.

Yet, not all of Son’s bets paid off. His investments in Uber led to years of paper losses, and his foray into WeWork is often cited as a significant misstep. Son ignored warnings from his team and fell “in love” with WeWork’s founder, Adam Neumann, assigning an astronomical $47 billion valuation to the co-working firm in early 2019. Unfortunately, WeWork’s disastrous IPO attempt, catapulted by a troubling S-1 filing, resulted in massive losses for SoftBank—amounting to $11.5 billion in equity and an additional $2.2 billion in debt. Son later referred to this investment as “a stain on my life.”

A New AI Frontier

Son’s latest pivot may signal a new chapter in his investing saga. On Tuesday, SoftBank confirmed it had sold off all 32.1 million Nvidia shares—not to reduce risk but to concentrate its efforts elsewhere, particularly in AI. The company has revealed plans for a significant $30 billion commitment to OpenAI and aims to participate in a tentatively proposed $1 trillion AI manufacturing hub in Arizona.

SoftBank’s exit from Nvidia, priced at approximately $181.58 per share, took place just 14% below the company’s all-time high of $212.19—a relatively strong showing for such a substantial sell-off. This marks SoftBank’s second complete exit from Nvidia; its first in 2019, when it sold a $4 billion stake for just $3.6 billion, significantly underestimated the company’s potential. Those shares would now be worth over $150 billion, highlighting the risks involved in SoftBank’s earlier decisions.

Market Reactions and Future Speculations

The market response to this latest move has been telling. Nvidia shares dipped nearly 3% following the announcement, with analysts quick to clarify that SoftBank’s sale shouldn’t be interpreted as a negative view on Nvidia itself. Instead, it reflects the firm’s need for capital to further its ambitious AI projects.

As Wall Street observes the developments, many are left to ponder: does Son possess insights into the future of AI that the average investor has yet to grasp? His remarkable record suggests he might. However, the uncertainty surrounding each of his large-scale decisions remains a constant factor that investors must consider.

Conclusion: Riding the AI Wave

Masayoshi Son’s ambitious approach continues to captivate the business world, and his recent decision to liquidate his substantial Nvidia stake illustrates his commitment to AI and a proactive strategy to recoup from past setbacks. As he positions SoftBank for future growth, his track record serves as a reminder that high-risk investments can lead to both remarkable triumphs and devastating losses. In the rapidly evolving landscape of technology and innovation, only time will reveal whether Son’s latest gamble pays off.

In summary, whether regarded as a visionary or a gambler, Son’s career provides valuable lessons about risk, resilience, and the relentless pursuit of opportunity. His latest foray into AI could be another chapter of triumph or another cautionary tale—only time will tell.

Thanks for reading. Please let us know your thoughts and ideas in the comment section down below.

Source link

#SoftBanks #Nvidia #sale #rattles #market #raises #questions