Nvidia’s $57B revenue and optimistic outlook silences concerns over AI bubble.

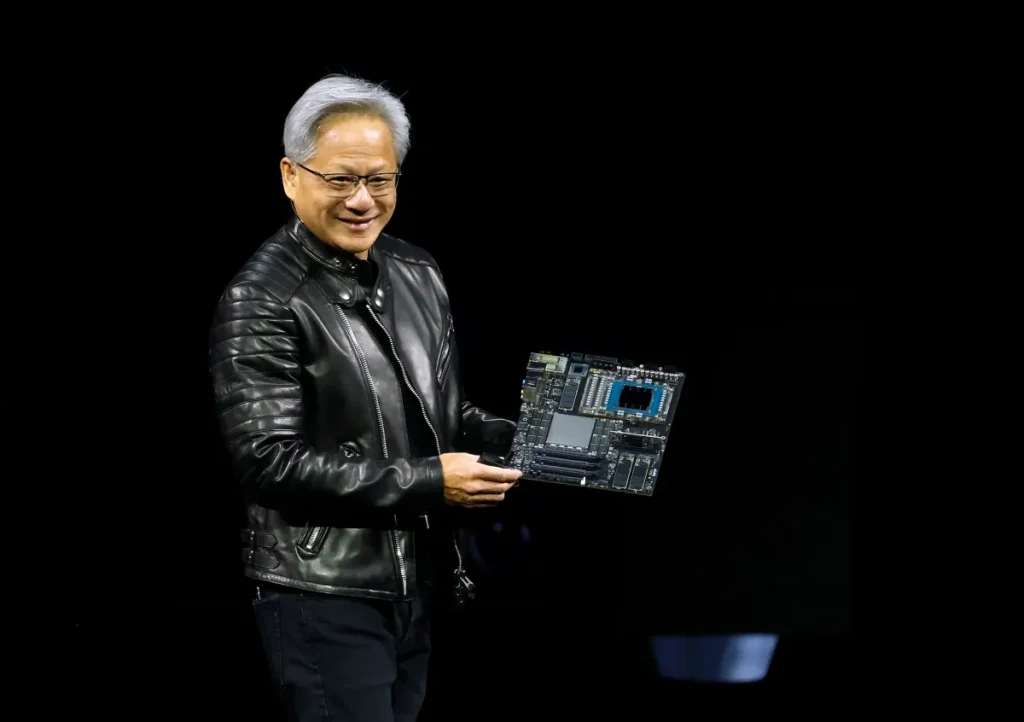

Image Credits:Justin Sullivan / Getty Images

Nvidia’s Strong Q3 Earnings Highlight Thriving AI and Data Center Business

Nvidia, led by its founder and CEO Jensen Huang, has reported impressive third-quarter earnings that indicate robust growth in the company’s operations, particularly within its data center sector. As AI technology continues to revolutionize various industries, Nvidia’s financial performance reflects the burgeoning demand for high-performance computing solutions.

Q3 Financial Performance Overview

In the third quarter, Nvidia posted a remarkable revenue of $57 billion, marking a 62% increase compared to the same quarter last year. The company’s net income on a GAAP basis surged to $32 billion, representing a 65% year-over-year rise. Both revenue and profit significantly surpassed Wall Street’s expectations, demonstrating Nvidia’s capacity to capitalize on advancements in artificial intelligence and data processing capabilities.

Data Center Business Drives Growth

The bulk of Nvidia’s revenue growth can be attributed to its thriving data center business, which generated a record $51.2 billion in revenue during the quarter. This figure is a 25% increase from the previous quarter and a 66% surge year-over-year. The gaming segment contributed an additional $5.8 billion, with $4.2 billion coming specifically from gaming-related products. Revenue from professional visualization and automotive divisions added to Nvidia’s impressive financial landscape.

Insights from CFO Colette Kress

Nvidia’s Chief Financial Officer, Colette Kress, shared insights into the factors propelling growth within the data center sector. She indicated that this growth is largely driven by an acceleration in computing power, advanced AI models, and applications that leverage these technologies. During the earnings call, Kress highlighted that the company has initiated AI factory and infrastructure projects amounting to an impressive 5 million GPUs.

Kress emphasized the expansive demand for these products across various sectors, including cloud service providers (CSPs), government entities, innovative enterprises, and supercomputing centers. She stated, “This demand spans every market, and includes multiple landmark buildouts.”

Blackwell Ultra: A Game-Changer

The introduction of the Blackwell Ultra GPU, unveiled in March, has proven to be a significant contributor to Nvidia’s success. Available in several configurations, the Blackwell Ultra has rapidly become the company’s leading product. Previous iterations of the Blackwell architecture have also maintained strong demand, according to company reports.

Jensen Huang remarked that sales of Blackwell GPU chips are “off the charts,” indicating outsized demand from various sectors. “Compute demand keeps accelerating and compounding across training and inference—each growing exponentially,” he added, signaling the advent of a “virtuous cycle” for AI technologies.

The AI Ecosystem and Future Outlook

Huang pointed out a critical observation during the earnings call: the AI ecosystem is expanding at an unprecedented rate, with an influx of new foundation model creators and AI startups emerging across diverse industries and countries. He noted, “AI is going everywhere, doing everything, all at once.” This robust outlook underlines Nvidia’s potential to maintain its market leadership as AI continues to evolve.

Challenges with China and H20 Shipments

Despite the overall positive performance, there were challenges that Nvidia faced, specifically regarding the shipment of its H20 data center GPU, designed for generative AI and high-performance computing. Kress reported that shipments reached 50 million, which fell short of expectations due to geopolitical tensions and a highly competitive market in China.

She explained that “sizable purchase orders never materialized in the quarter,” and reiterated Nvidia’s commitment to engaging with both U.S. and Chinese governments to navigate the complexities of international trade and competition. Kress expressed disappointment over the current challenges that inhibit shipping more competitive data center products to China but maintained that Nvidia remains steadfast in its advocacy for American competitiveness on the global stage.

Projected Growth and Market Reactions

Looking ahead, Nvidia has forecasted even more growth, projecting revenue of $65 billion in the fourth quarter. This bullish outlook has already positively influenced the company’s stock, pushing share prices up more than 4% in after-hours trading.

Conclusion: A Bright Future Ahead

In conclusion, Nvidia’s remarkable third-quarter performance underscores the rapid growth in AI and data center business sectors that the company is experiencing. CEO Jensen Huang’s insights conveyed a clear message for investors: forget the talk of a potential AI bubble; what we see is undeniable growth.

As Nvidia continues to navigate challenges while expanding its capabilities through innovative products like the Blackwell GPU and adapting to the evolving landscape, the company seems poised for a prosperous future in the AI market. As industries increasingly incorporate AI-driven solutions, Nvidia’s role as a leader in high-performance computing will likely remain unchallenged.

Thanks for reading. Please let us know your thoughts and ideas in the comment section down below.

Source link

#Nvidias #record #57B #revenue #upbeat #forecast #quiets #bubble #talk