Nvidia’s AI Dominance: An Overview of Key Startup Investments

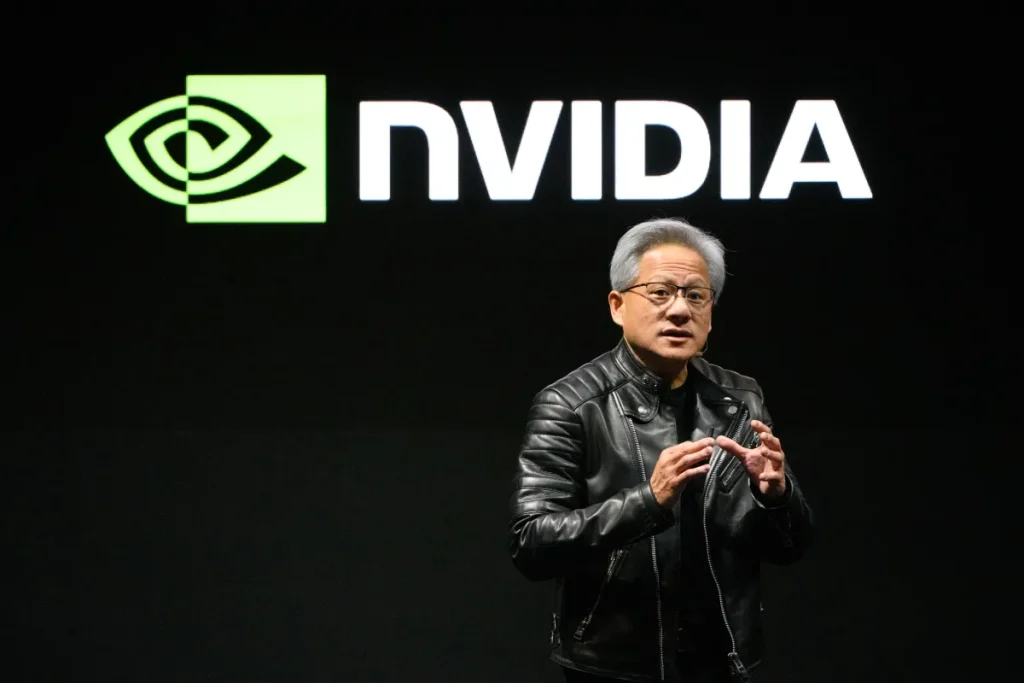

Image Credits:Akio Kon/Bloomberg / Getty Images

Nvidia: The Vanguard of the AI Revolution

Nvidia has emerged as a dominant force in the rapidly evolving landscape of artificial intelligence (AI). Since the launch of ChatGPT over three years ago, the company’s revenue and profitability have surged, alongside a remarkable increase in cash reserves. Nvidia’s stock price has soared, propelling it into the elite realm of companies with a market capitalization of $4.6 trillion.

Strategic Investments in AI Startups

Seizing its newfound wealth, Nvidia has significantly ramped up its investment in startups, particularly those in the AI sector. In 2025 alone, the company participated in 67 venture capital deals, surpassing the 54 it completed for the entire year of 2024. This surge in activity is complemented by the activities of its corporate venture capital fund, NVentures, which also saw a dramatic increase in investment, engaging in 30 deals compared to just one in 2022.

Nvidia’s corporate strategy is clear: to cultivate the AI ecosystem by investing in startups that have the potential to be “game changers and market makers.” This foresight has extended Nvidia’s influence well beyond a hardware provider to a vital player in the tech industry’s future.

Notable Investments: The Billion-Dollar-Round Club

Nvidia’s involvement in funding rounds has positioned it prominently among tech giants. Here are some of the notable startups in which Nvidia has participated:

OpenAI

In October 2024, Nvidia made its inaugural investment in OpenAI, contributing $100 million to a monumental $6.6 billion funding round, valuing the company at $157 billion. While Nvidia’s investment was substantial, it paled in comparison to leading investor Thrive, which put in $1.3 billion. Despite not participating in OpenAI’s $40 billion round in March, Nvidia announced in September its intention to invest up to $100 billion in a strategic partnership to fortify AI infrastructure.

Anthropic

Nvidia’s first direct investment in Anthropic came in November 2025, where it committed up to $10 billion in a strategic round alongside major backers like Microsoft. This circular agreement enables Anthropic to allocate $30 billion to Azure compute resources while purchasing Nvidia’s future technology systems.

Cursor

In November 2025, Nvidia made a strategic investment in Cursor, an AI-powered coding assistant, partaking in a $2.3 billion Series D round that saw the company’s valuation soar to $29.3 billion—an astonishing nearly 15-fold increase since the start of the year.

xAI

Despite OpenAI’s efforts to sway its investors against rival companies in 2024, Nvidia participated in a $6 billion funding round for Elon Musk’s xAI. Additionally, Nvidia plans to invest up to $2 billion in the equity portion of xAI’s upcoming $20 billion funding round.

Mistral AI

Nvidia made its third investment in Mistral AI in September when the French company raised €1.7 billion in a Series C funding round, achieving a post-money valuation of approximately $13.5 billion.

Reflection AI

In October, Nvidia joined a $2 billion funding round for Reflection AI, a startup competing against established names like OpenAI and Anthropic. With a valuation of $8 billion, Reflection aims to be a U.S.-based alternative to Chinese models.

Thinking Machines Lab

Nvidia was also among the investors in former OpenAI CTO Mira Murati’s Thinking Machines Lab, which managed to raise $2 billion in a seed round announced in July.

Medium-Sized Investments: The Hundreds-of-Millions-of-Dollars Club

Aside from its billion-dollar ventures, Nvidia has also engaged in numerous funding rounds exceeding $100 million, showcasing its extensive reach within the tech ecosystem.

Commonwealth Fusion

In August 2025, Nvidia participated in an $863 million round for a nuclear fusion startup valued at $3 billion.

Cohere

The Toronto-based company Cohere benefitted from Nvidia’s investment across multiple rounds, including a $500 million Series D that increased Cohere’s valuation to $6.8 billion.

Poolside

Nvidia invested in Poolside’s $500 million round in October 2024, valuing the AI coding assistant startup at $3 billion.

Lambda

In February, Nvidia contributed to Lambda’s Series D round, which raised $480 million at a valuation of $2.5 billion.

Firmus Technologies

In September, Nvidia was among the investors in Firmus Technologies’ funding round of approximately $215 million, which focused on developing an energy-efficient “AI factory” in Tasmania.

Smaller Investments: Deals of Over $100 Million

In addition to the higher-profile investments, Nvidia has also recognized the potential of emerging technologies. Here are some deals worth noting:

Ayar Labs

In December 2024, Nvidia participated in a $155 million round for Ayar Labs, a company focused on enhancing AI compute and energy efficiency.

Sandbox AQ

Nvidia joined a consortium of investors to provide $150 million for Sandbox AQ, a startup dedicated to developing quantitative models for complex analysis.

Weka

In May 2024, Nvidia took part in Weka’s $140 million round, further establishing its footprint in AI-native data management.

Runway

In April, Nvidia helped secure a $308 million funding round valued Runway at $3.55 billion.

Conclusion: Nvidia’s Pivotal Role in Shaping AI’s Future

Nvidia’s aggressive investment strategy not only reflects its confidence in the AI sector but also establishes it as a cornerstone in the ongoing AI revolution. By backing promising startups and fostering innovation, Nvidia is not just reaping financial rewards; it is also shaping the future landscape of artificial intelligence.

As AI continues to develop rapidly, Nvidia’s strategic investments will likely play a crucial role in identifying and nurturing the next generation of technology leaders. With its focus on “game-changing” startups, Nvidia is poised to remain a key player in the technology narrative for years to come.

Thanks for reading. Please let us know your thoughts and ideas in the comment section down below.

Source link

#Nvidias #empire #top #startup #investments